One should not have to be forced to help the poor – we should do so voluntarily out of love. Moreover, one cannot take the position that the poor should be left to themselves, suggesting that having and raising children – if one hasn’t the means – is foolish and does not merit the assistance of others in order to provide for the basic needs of a family. If you’re poor, some argue, don’t have kids. This we have called the passive economic genocide of the poor.

However, when the needs of the poor – all around the world – are not met by our voluntary giving, while others keep superfluous wealth, it would seem to be the case that force – that is, violence – can be used to take from the excesses of those who possess it for the sake of the common good.

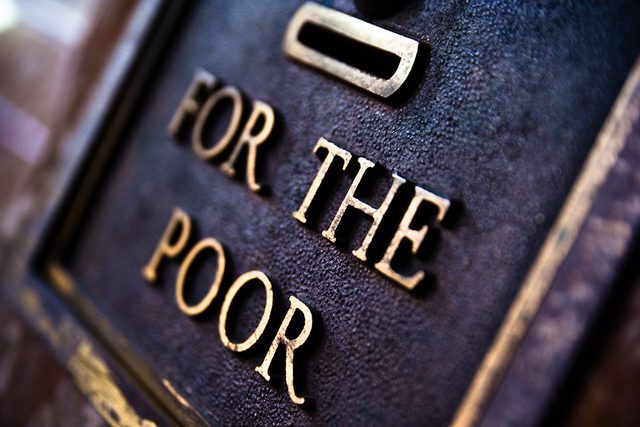

So, in this post, let us consider a few words from our tradition on relieving the poor from their misery, and how the poor have a right to this relief.

It seems that voluntary giving, without the organizing effort of some higher level of society – whether this be the Church or the State -, has not been able to secure and protect the basic needs of our neighbors.

Is it theft, then, to have what is in our possession, if it is excess, taken from us in order to satisfy the basic needs of the poor? Can the state do so and it not be considered robbery? Should the poor, if they are in need, hold back from taking what is needed for their lives and rely on private ‘charity’ – and if that’s not enough, perish?

Let us consider a few words from St. Thomas Aquinas.

From the Second Part of the Second Part (Secunda secundae) of the Summa Theologica, Question 66, Articles 7-8, we read:

Wherefore the division and appropriation of things which are based on human law, do not preclude the fact that man’s needs have to be remedied by means of these very things. Hence whatever certain people have in superabundance is due, by natural law, to the purpose of succoring the poor. For this reason Ambrose says, and his words are embodied in the Decretals: “It is the hungry man’s bread that you withhold, the naked man’s cloak that you store away, the money that you bury in the earth is the price of the poor man’s ransom and freedom.”

Since, however, there are many who are in need, while it is impossible for all to be succored by means of the same thing, each one is entrusted with the stewardship of his own things, so that out of them he may come to the aid of those who are in need. Nevertheless, if the need be so manifest and urgent, that it is evident that the present need must be remedied by whatever means be at hand (for instance when a person is in some imminent danger, and there is no other possible remedy), then it is lawful for a man to succor his own need by means of another’s property, by taking it either openly or secretly: nor is this properly speaking theft or robbery.

This is all consistent with what we call the Universal Destination of Goods. Aquinas continues:

It is not theft, properly speaking, to take secretly and use another’s property in a case of extreme need: because that which he takes for the support of his life becomes his own property by reason of that need.

Can this “taking” be done for the sake of a neighbor in need? It seems Aquinas finds it acceptable:

In a case of a like need a man may also take secretly another’s property in order to succor his neighbor in need.

Lastly, from Aquinas, in addition to individuals, the State may take – using force – what is necessary for the common good:

It is no robbery if princes exact from their subjects that which is due to them for the safe-guarding of the common good, even if they use violence in so doing…

It should not be a surprise for Catholics to learn that the Church accepts the role of the State, where necessary, to demand what is necessary from the excesses of some for the protection of justice.

Again, the State can, if it is necessary, take and distribute where justice is not met. Force may be used where appropriate.

Many see taxes as a way for the State to organize and pay for public goods that are difficult to effectively supply if left to private initiative: roads, military, etc.

The idea that the State would use the force of taxes to supply for the needs of the poor may sound ridiculous to many unfamiliar with the inadequacy of private-charity-alone solutions to poverty.

Leo XIII agrees that the State should make sure the poor are cared for:

Rights must be religiously respected wherever they exist, and it is the duty of the public authority to prevent and to punish injury, and to protect every one in the possession of his own. Still, when there is question of defending the rights of individuals, the poor and badly off have a claim to especial consideration. The richer class have many ways of shielding themselves, and stand less in need of help from the State; whereas the mass of the poor have no resources of their own to fall back upon, and must chiefly depend upon the assistance of the State. And it is for this reason that wage-earners, since they mostly belong in the mass of the needy, should be specially cared for and protected by the government. (Rerum Novarum, #37)

Leo then, pushing for a greater number of property owners, puts limits on the amount a state can tax:

The right to possess private property is derived from nature, not from man; and the State has the right to control its use in the interests of the public good alone, but by no means to absorb it altogether. The State would therefore be unjust and cruel if under the name of taxation it were to deprive the private owner of more than is fair. (Rerum Novarum, #47)

Truly, then, the fact that excessive taxation is unjust leaves us to accept that taxation in itself is not necessarily unjust. It would be less necessary, however, if justice were secured in employee-employer relations concerning, among other things, wages:

Let the working man and the employer make free agreements, and in particular let them agree freely as to the wages; nevertheless, there underlies a dictate of natural justice more imperious and ancient than any bargain between man and man, namely, that wages ought not to be insufficient to support a frugal and well-behaved wage-earner. If through necessity or fear of a worse evil the workman accept harder conditions because an employer or contractor will afford him no better, he is made the victim of force and injustice. In these and similar questions, however – such as, for example, the hours of labor in different trades, the sanitary precautions to be observed in factories and workshops, etc. – in order to supersede undue interference on the part of the State, especially as circumstances, times, and localities differ so widely, it is advisable that recourse be had to societies or boards such as We shall mention presently, or to some other mode of safeguarding the interests of the wage-earners; the State being appealed to, should circumstances require, for its sanction and protection. (Rerum Novarum, #45)

Let’s make sure wages are adequate, and our private, community efforts are satisfactory to a degree that reduces the justification for State involvement. As the conservative moral theologian, Germain Grisez, writes:

If employers cannot [pay an adequate family wage], however, the principle of subsidiarity indicates that the larger society should adopt some method—for example, tax advantages for workers supporting families, grants to women working full time as mothers and homemakers, family allowances, and/or public subsidies to poor families—of making up the difference between a family wage and an adequate individual wage.

But, while taxes and programs that use them can become inefficient, reform, not abandonment, is required. Above all, considering taxes used for public programs to help the poor as ‘unjust’ is in itself an argument that is “not sound.” Grisez continues:

Some more or less well-to-do people rationalize tax evasion by arguing that the tax they evade is unjust because it will fund public programs to aid the poor. To be sure, particular tax laws and particular programs for the poor may be unjust, but the general argument is not sound.

We do have our duties to the poor – and they cannot wait.

Yes we should help the poor. When our help is not enough, higher levels of social organization may/must step in as needed.

Pius XI writes,

When these means which We have pointed out do not fulfill the needs, particularly of a larger or poorer family, Christian charity towards our neighbor absolutely demands that those things which are lacking to the needy should be provided; hence it is incumbent on the rich to help the poor, so that, having an abundance of this world’s goods, they may not expend them fruitlessly or completely squander them, but employ them for the support and well-being of those who lack the necessities of life. They who give of their substance to Christ in the person of His poor will receive from the Lord a most bountiful reward when He shall come to judge the world; they who act to the contrary will pay the penalty. (Casti Connubii, 1930, #119)

If “private resources do not suffice”, guess who has the duty to step in:

If, however, for this purpose, private resources do not suffice, it is the duty of the public authority to supply for the insufficient forces of individual effort, particularly in a matter which is of such importance to the common weal, touching as it does the maintenance of the family and married people. If families, particularly those in which there are many children, have not suitable dwellings; if the husband cannot find employment and means of livelihood; if the necessities of life cannot be purchased except at exorbitant prices; if even the mother of the family to the great harm of the home, is compelled to go forth and seek a living by her own labor; if she, too, in the ordinary or even extraordinary labors of childbirth, is deprived of proper food, medicine, and the assistance of a skilled physician, it is patent to all to what an extent married people may lose heart, and how home life and the observance of God’s commands are rendered difficult for them; indeed it is obvious how great a peril can arise to the public security and to the welfare and very life of civil society itself when such men are reduced to that condition of desperation that, having nothing which they fear to lose, they are emboldened to hope for chance advantage from the upheaval of the state and of established order. (Casti Connubii, 1930, #120)

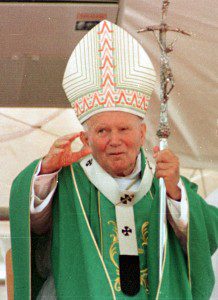

The State has a lot of responsibility. But, as John Paul II would later agree, this responsibility should be considered a service and protection for the family institution. Pius Xi continues:

Wherefore, those who have the care of the State and of the public good cannot neglect the needs of married people and their families, without bringing great harm upon the State and on the common welfare. Hence, in making the laws and in disposing of public funds they must do their utmost to relieve the needs of the poor, considering such a task as one of the most important of their administrative duties. (Casti Connubii, 1930, #121)

Pius XI also wrote, “The wage-earner is not to receive as alms what is his due in justice.”

Remember, the Church has taught that not only the State has the right to take what is necessary from the excesses of the rich to provide for the common good, the Second Vatican Council’s Gaudium et Spes, reminds us of Aquinas when insisting: “If one is in extreme necessity, he has the right to procure for himself what he needs out of the riches of others.”

Paul VI in Populorum Progressio (1967), repeated the warning we face, not simply when we fail in relieving the poverty of our closest neighbors in our communities and nation, but when we neglect the poor across the globe:

We must repeat that the superfluous goods of wealthier nations ought to be placed at the disposal of poorer nations. The rule, by virtue of which in times past those nearest us were to be helped in time of need, applies today to all the needy throughout the world. And the prospering peoples will be the first to benefit from this. Continuing avarice on their part will arouse the judgment of God and the wrath of the poor, with consequences no one can foresee. (#49)

What will happen if we continue to deny the poor what belongs to them? When the poor rise up, will we finally give what is theirs? Or shall we simply repress them, as we’ve done, and use more weapons of death to maintain our extravagant life styles?

John Paul II (as we mentioned above) saw the need for protection and assistance for families:

It can happen, however, that when a family does decide to live up fully to its vocation, it finds itself without the necessary support from the State and without sufficient resources. It is urgent therefore to promote not only family policies, but also those social policies which have the family as their principle object, policies which assist the family by providing adequate resources and efficient means of support, both for bringing up children and for looking after the elderly, so as to avoid distancing the latter from the family unit and in order to strengthen relations between generations. (Centesimus Annus, #49)

How can the state make this happen without taxes? Will you voluntarily contribute and work to make things more efficient to the end of greater justice for all? Or will we complain, call it theft and violence, and continue to deny the poor’s right to life?

As the US Bishops wrote in their 1987 pastoral letter, Economic Justice for All:

The responsibility for alleviating the plight of the poor falls upon all members of society. As individuals, all citizens have a duty to assist the poor through acts of charity and personal commitment. But private charity and voluntary action are not sufficient. We also carry out our moral responsibility to assist and empower the poor by working collectively through government to establish just and effective public policies … charity alone is not a corrective to all economic social ills. All citizens, working through various organizations of society and through government, bear the responsibility of caring for those who are in need.

We need to help the poor. We need to give of our own resources. Organized action, at times at the State or International levels, is necessary. We should not only seek to relieve the poor now, across the world, but also to secure justice in systemic relations to allow for full participation in social and economic life.

As we read above, let’s secure food, clothing, housing, clean water, access to culture, dignified employment, time for religious practice, education, etc., for our brothers and sisters. It is their right. If employment relations do not secure these rights, let’s work together to provide for our neighbors’ needs. If we can’t do it on our own, or choose not to, higher levels of organizing may/must step in – using violence, that is, force, if necessary to provide for the needy.

Let’s make the system more just – so that a living wage can be secured from the get-go. But we must act on behalf of justice. Paul VI reminds us of our need to re-examine our conscience in light of these circumstances:

On the part of the rich man, it calls for great generosity, willing sacrifice and diligent effort. Each man must examine his conscience, which sounds a new call in our present times. Is he prepared to support, at his own expense, projects and undertakings designed to help the needy? Is he prepared to pay higher taxes so that public authorities may expand their efforts in the work of development? Is he prepared to pay more for imported goods, so that the foreign producer may make a fairer profit? Is he prepared to emigrate from his homeland if necessary and if he is young, in order to help the emerging nations?

If not, we can (and should) expect the force of the state – and we may prepare ourselves to suffer the wrath of the poor.

We can’t keep using capitalism to acquire excess funds to then pretend we are getting Heavenly brownie points by giving what is due to the poor by right. With all of our interest in protecting marriages and families, we should move beyond capitalism for the good of rich and poor families alike! The Church will not accept this. As Jorge Bergoglio (now Pope Francis) wrote:

We are tired of systems that generate poor people for the church then to look after.

The Church continues to call for the actualization of just structures – what did Francis say in Laudato si’?

Let’s change the system and let’s help the poor without delay.

Until next time,

p.s. We haven’t exhausted this topic. Many in the religious-right support individual efforts in poverty relief and insist that not much else – if anything – should be provided for by the government. Peter Singer also has an interesting, and similar, position on poverty relief, which we will discuss another time in the greatest of detail.

**This post was originally published on December 17, 2015 on Proper Nomenclature.**