Warren Buffett seems like a nice old man. He’s not.

When the billionaire philanthropist first moved into the manufactured home business, it seemed like his much-touted philosophy of investing for value would be a boon to the industry that provides so much of America’s affordable housing stock. His reputation as an investor who sought out quality goods and services, growing his fortune with their success, suggested that Buffett would focus on the beneficial aspects of factory-built homes, leading away from the unsustainable predatory practices and value-less rent-seeking that have plagued the business.

But that didn’t happen. Buffett’s “value” talk, it turns out, is pure shinola. And he’s raised value-less rent-seeking to an art form.

Mike Baker and Daniel Wagner of the Seattle Times and the Center for Public Integrity have detailed Buffett’s ugly strategy of gouging the poor in a devastating exposé, “The mobile-home trap: How a Warren Buffett empire preys on the poor“:

Buffett’s mobile-home empire promises low-income Americans the dream of homeownership. But Clayton relies on predatory sales practices, exorbitant fees, and interest rates that can exceed 15 percent, trapping many buyers in loans they can’t afford and in homes that are almost impossible to sell or refinance. …

Berkshire Hathaway, the investment conglomerate Buffett leads, bought Clayton in 2003 and spent billions building it into the mobile-home industry’s biggest manufacturer and lender. Today, Clayton is a many-headed hydra with companies operating under at least 18 names, constructing nearly half of the industry’s new homes and selling them through its own retailers. It finances more mobile-home purchases than any other lender by a factor of six. It also sells property insurance on them and repossesses them when borrowers fail to pay.

… More than a dozen Clayton customers described a consistent array of deceptive practices that locked them into ruinous deals: loan terms that changed abruptly after they paid deposits or prepared land for their new homes; surprise fees tacked on to loans; and pressure to take on excessive payments based on false promises that they could later refinance.

Former dealers said the company encouraged them to steer buyers to finance with Clayton’s own high-interest lenders.

Warren Buffett hasn’t invested in manufactured housing. He’s invested in ripping off working-class and elderly people who don’t have the power to fight back. Buffett’s “Clayton Homes” is not a business that sells housing. It’s a pretext for high-interest loans to milk families dry before expelling their penniless husks and moving on to the next victim.

An editorial from the East Oregonian sums up the only conclusion possible from reading Baker and Wagner’s report. “There’s nothing wrong with mobile homes,” the paper says. “But there’s a lot wrong with taking advantage of those who lack good alternatives”:

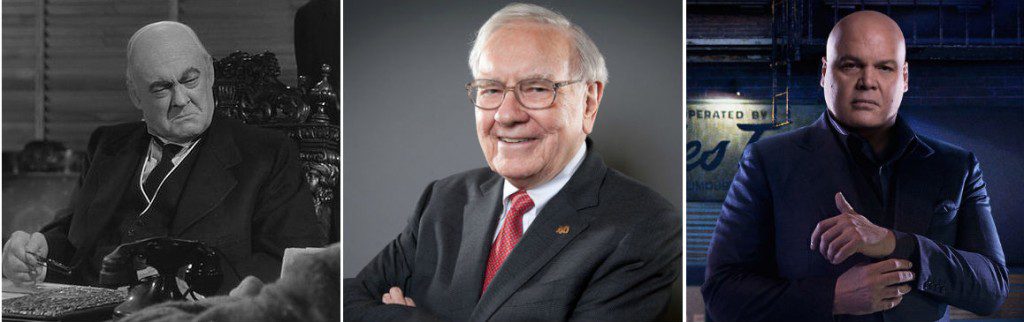

It’s like discovering the person we thought was Santa Claus is actually rapaciously mean old banker Mr. Henry F. Potter from It’s a Wonderful Life: respected philanthropist Warren Buffet turns out to be America’s worst mobile-home slumlord.

This is the conclusion of an investigative series by the Seattle Times and the Center for Public Integrity, the first part of which was published April 2. Buffet’s Berkshire Hathaway, the legendary investment conglomerate that has built a reputation for sensible acquisitions of famous American companies, owns a veritable rat’s nest of mobile-home interests collectively known as Clayton.

Again, Clayton is not a company that provides affordable homes for low-income families and retired people. Clayton is a company that uses the need for affordable housing as a pretext for draining as much money as possible from low-income families and retired people before ultimately leaving them homeless. Warren Buffett did not invest in affordable housing. Warren Buffett invested in usury — in unaffordable, predatory lending.

How is the formerly respected third-richest man in the world responding to evidence that he’s an enormous sleazeball who’s been lying to his investors for decades with his bogus “value” talk?

By doubling-down on the sleaze. Just days after this report exposed the old vampire’s morally repugnant practices, his lobbyists got his congressional henchmen to push a bill through the House of Representatives deregulating the manufactured-home loans Buffett uses to fleece the poor.

To quote my favorite economist, I’d say that makes the so-called Sage of Omaha nothing but a scurvy little spider.